Guide

Reinventing your segmentation to fuel growth

Since the last economic crisis, sales practitioners have been in a somewhat bumpy learning journey to deal with the changes happening with their customers.

The learning is particularly difficult because the customer doesn’t show his cards to the salesperson. Today the game is in the hands of the buyer, and the buyer has become more demanding than ever. Buyers are often not open to hear a value pitch by a selling firm, and even less when that pitch requires a face-to-face meeting with a salesperson.

So, are sales organizations predestined to let their sales offers to be bought as commodities?

The answer lies in the categorization of your sales offer through the eyes of your customer.

By reading this guide you will:

- Learn the power of segmentation

- Learn how to better understand your buyers

- Learn a framework and process for fueling growth

- Learn how to plan a segmentation strategy

The death of the average salesmen is near

The buyer-seller landscape has been evolving at a rapid pace. Most salesmen have understood that the buyer is becoming more demanding and that buying is a complex process that takes place by different roles; 6.8 to be precise (The challenger customer, CEB).

At the same time, this buyer is only interested in meeting salespeople for 17% of the time (Gartner), and only when the buying decision is almost made (The challenger sale, CEB). And when this buyer is meeting salespeople, the value of that meeting is perceived as low in 85% of the cases (Forrester).

The most often mentioned reason for these changes happening at the buyer side is that the buyers have all the information at the tip of their fingers. To put it in other words: the buyer’s access to online information has been the main gamechanger.

Purchasers in the driver seat

The underlying reason, however, is not the access to information, but the job pressure that buyers are dealing with. Think about your own household. Do you spend the same amount of time and efforts for all your purchases? Most probably you don’t spend one-hour time to buy your regular soda. And most likely you are not interested in having a weekly face-to-face meeting with the petrol station manager neither. The same counts for professional buyers. These people have responsibilities of purchasing up to 2,000 different items, and just like you, these people are also limited in time and resources. The responsibilities of the purchasing function have been surging since the last economic crisis in 2008-2009. The reason of these increased responsibilities originates from top management who has empowered the purchasing function for simple, but clear reasons: It is the purchasing function who controls the company’s expenditures, ranging from 50% to 90% of the goods sold.

A better understanding of buyers

In times of crises, it is the purchaser who is in the driver’s seat to manage the costs, and hence, a large part of the profitability of the buying firm. All four global crises since the World War II have been the starting point of the next level of purchasing empowerment.

The question for sales managers now becomes: How should sales organizations deal with these enabled purchasers?

How to answer

1. Sales organizations should first have a clear understanding of what the purchasing function is desiring from the business relationship with the sales organization.

2. Based on this learning, selling firms must adapt their segmenting strategy

Increase your profits with a simple framework

If there would be a purchasing god, his name would be Peter Kraljic. His framework is the backbone of purchasing.

Despite sales organizations are focusing their sales efforts on becoming more customer-centric, most sales practitioners have never worked with nor heard of this framework.

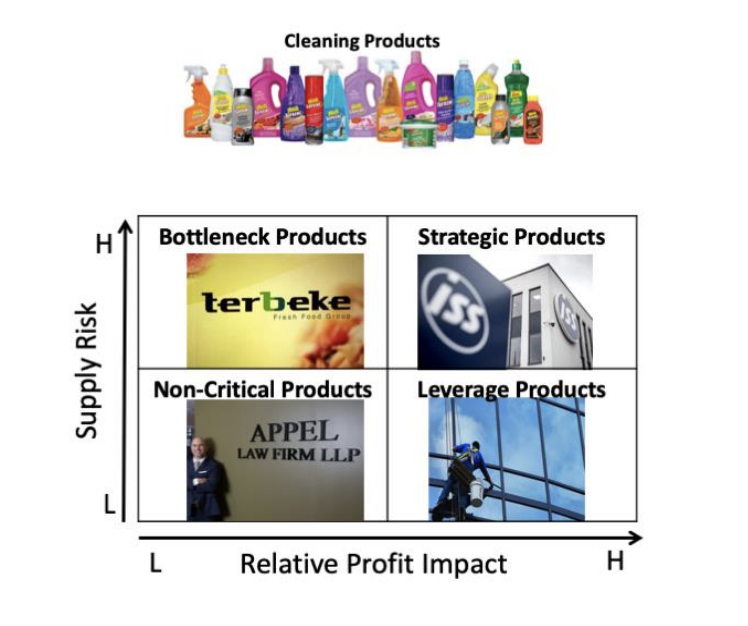

The matrix, as visualized below with the example of cleaning products, consist of two axes combining the relative profit impact and the supply risk for the buying firm.

On the following pages you will learn how to apply the framework from a seller’s perspective.

© Prof . dr. Bert Paesbrugghe

The framework explained in-depth

A high perceived supply risk implies a combination of 1) having only few suppliers in the market and 2) not having the item would (almost) put a full stop to the buying company’s business.

Next, the relative profit impact is based on how much the buying firm is spending on this item in comparison to their total spend. Note that this matrix is based on the relative profit impact for the buying firm, instead of how big this customer is for your selling firm.

The four resulting product categories differentiate the buyer’s journey completely. This is a subjective exercise because the same sales offer, i.e. cleaning products, will be categorized differently depending on the purchaser’s company. For a small lawyer firm, the purchaser might consider the same cleaning products as non-critical items, whereas a purchaser at a large facility service firm probably categorizes these as leverage items or strategic items.

In theory, the purchasing strategy for each product category has been well documented: for non-critical items, purchasers should increase their efficiency; for leverage products, purchasers should leverage their purchasing position; for bottleneck products, purchasers should secure supply; and finally for strategic products, purchasers need to develop partnerships.

This has a tremendous impact on how these purchasers look at their relationships with salespeople and calls for a fresh view on segmentation by the selling firm.

Strategic Exercise Part 1

At the end of this guide, you will find a template of the Kraljic purchasing portfolio matrix.

Given your customers situation, how do they categorize your sales offer (Non-critical; Leverage; Bottleneck; Strategic product/service).

Make sure that you stick to the purchasers’ point of view when assessing how they would categorize your specific sales offer.

Low Supply Risk

Purchasers are showing different needs from salespeople depending on how they categorize the sales offer in the Kraljic matrix. The supply risk axis is differentiating the purchaser’s buying journey as follow.

Low Supply Risk

When the perceived supply risk is low (thus, non-critical and leverage products), then purchasers want to have a very efficient purchasing process, even though the deal volume might be substantial.

The buyer’s efficiency can get a boost by not meeting with salespeople. As an example, consider how much a family spends on average on their energy or telephone bills.

Would they like to see a salesperson every month and get insights on what the energy market will look like in five years from now, or would they like to have a convenient buying process that helps them reduce their energy consumption and direct them when they can save money on their bills?

How to improve your segmentation plan

The sales segmentation plan should be developed in such way that it matches the buyer’s efficiency goals. Yet, when we zoom in on the B2B world, it is surprising to find how many of these companies make it horribly difficult to purchase from. If you were a buyer, would you like to have a meeting to decide on the sticky notes (non-critical product) or the office paper in the office (leverage product), or would you consider a comparison website that is swift and easy?

Questions for sales practitioners to think about are:

- How can we make the purchasing process easier?

- Do these purchasers get full access to all the information they need to make a purchasing decision?

- Can we facilitate the (recurring) purchases by (further) easing their ordering, invoicing, or communication desires?

The buying journey for these types of products will follow the path of the least resistance. Anything that takes too much time will push the purchaser towards a different supplier.

When your products are categorized as having a low supply risk, look for inspiration in the customer convenience shown at the most famous B2C firms, such as Amazon, Netflix, Uber, Deliveroo, etc. Salespeople are not considered value-adding for these purchasers.

For the situation of leverage products, salespeople initially serve as an indicator of trustworthiness, but this trust issue could also be tackled by a strong B2B brand name. This approach, however, is totally not recommended for when your products are categorized as having a high supply risk for the purchasing firm.

High Supply Risk

When your sales offer is in high supply risk (bottleneck and strategic products), it is all about personal selling.

Purchasers are looking for know-how and innovation to mainly reduce the supply risks they are exposed to (bottleneck products), as well as for getting a competitive edge (strategic products) over their closest competitors. It is for these types of products that purchasers are keen on co-creation, co-innovation, joint ventures, risk sharing, etc.

The main recommendation is to trigger a face-to-face meeting between the purchaser and your sales team.

The future of selling: Purchaser-Centric

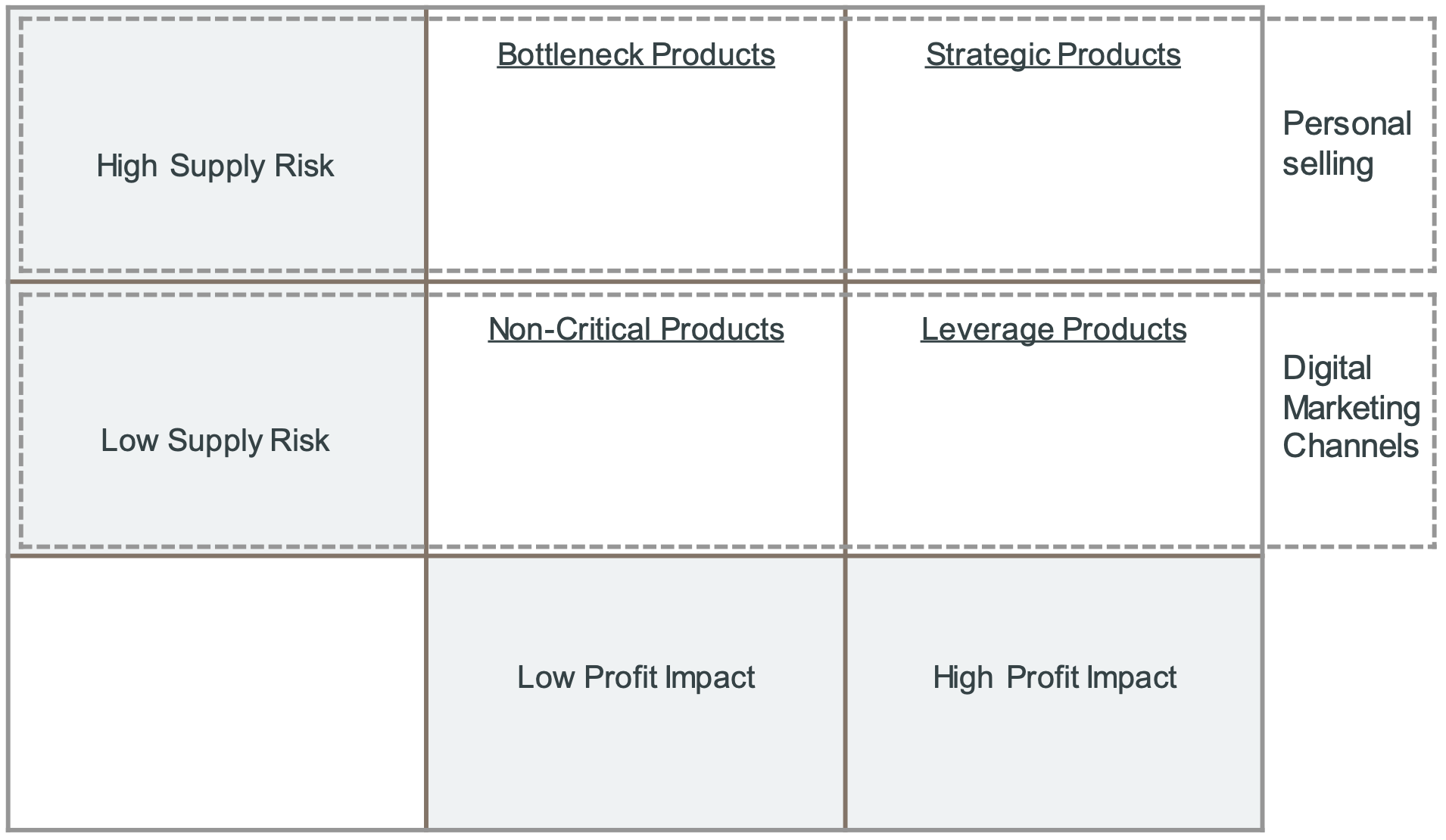

The segmentation approach that flows from the learnings above is that sales team efforts should be concentrated on purchasing firms who categorize your sales offer as having a high supply risk.

Counterintuitively, for the other two types of products (low supply risk for the purchaser), focus on facilitating the purchasing process by sharing this responsibility with the marketing department to develop digital marketing channels.

We hope that this whitepaper is thought-provoking and have made you think about your current segmentation approach.

Would you still hold on to the traditional way of doing segmentation: an ABC-analysis based on generated (future) turnovers/profitability?

Strategic Exercise template

About the Author

Prof. dr. Bert Paesbrugghe is a professor of sales management at IÉSEG School of Management in Paris and a visiting professor at Ghent University and Copenhagen Business School.

He holds a PhD in Business Economics from Ghent University and Vlerick Business School, and his research focuses on buyer-seller relationships in industrial contexts.

Bert has published his papers in different journals, such as Industrial Marketing Management, Journal of Business and Industrial Marketing, Journal of Retailing and Consumer services, and in the Journal of Personal Selling and Sales Management.

More recently, he won the first prize at the 20th American Marketing Association (AMA) Sales SIG doctoral dissertation award. Additionally, Bert is often invited as a keynote speaker for academics and practitioners and consults B2B companies.